in Focus

Designing the Future

of Entrepreneurship

2025 FKI CEO Jeju Summer Forum

FKI successfully co-hosted the 2025 FKI CEO Jeju Summer Forum, which was joined by more than 500 business leaders. Since its inception in 1986, the Jeju Summer Forum has grown into Korea’s largest economic knowledge-sharing platform, with over 10,000 CEOs having participated to date. It serves as a vital venue for senior executives to build networks and explore future strategies together. This year, the island of Jeju once again became a stage for powerful stories of challenge and innovation.

Photographer Dong-yeol Kim

“The theme of this forum—Entrepreneurial Spirit Turning Crisis into Opportunity, Challenge and Innovation—underscores the critical necessity of rekindling the spirit of entrepreneurship, especially in difficult times. As a “powerhouse for entrepreneurship,” FKI will continue doing its utmost to improve the business environment.”

- Jin Roy Ryu, Chairman of FKI

Now in its 38th year, the FKI CEO Jeju Summer Forum is held each July during Korea’s summer holiday season. Hosted by FKI, the forum provides CEOs with insights essential to corporate strategy. In addition to in-depth lectures, the program offers cultural sessions, sports, and performances that support personal development, networking, and rejuvenation.

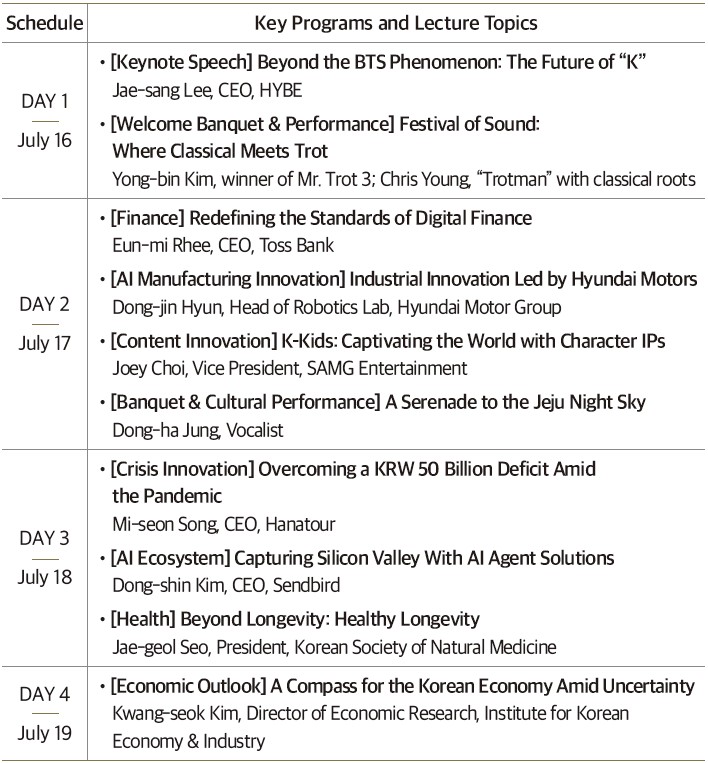

This year’s forum, held from July 16 to 19 under the theme “Entrepreneurial Spirit Turning Crisis into Opportunity, Challenge and Innovation,” welcomed industry leaders from sectors such as digital finance, robotics, tourism, and healthcare. These speakers shared forward-looking strategies and real-world cases of innovation in the face of accelerating change. The event also contributed to revitalizing Korea’s domestic tourism market in alignment with the broader K-Vacation initiative.

HYBE’s Global Expansion for Sustainable Growth

Jae-sang Lee CEO of HYBE

HYBE aspires to be a lifestyle entertainment platform rooted in music and technology. Since its founding in 2005, the company has grown to become Korea’s largest entertainment company by market capitalization and the fourth-largest globally among record labels. This article examines the crises HYBE has faced in the K-pop market and the innovative solutions that have enabled its rise as a global force in music.

A Commitment to “K” and a Calling to Transform the Content Industry

While HYBE’s current scale and pace of growth may appear to be the product of uninterrupted global success, its journey has been constantly marked by crises and reinvention. Every turning point in HYBE’s history involved reframing a challenge as an opportunity. In particular, the global ascent of the BTS brand sparked a deeper sense of responsibility toward “K” and highlighted the need for systemic innovation across the entertainment content industry.

As our artists gained global popularity and HYBE’s influence expanded, we began to embrace a greater sense of mission as a leading K-pop company. This led us to confront, earlier than most, the underlying risks facing the content industry. Our urgent internal discussions about K-pop’s global role culminated in a clear public message: In 2023, Chairman Si-hyuk Bang declared at the Kwanhun Forum that “we must recognize that the K-pop industry is in crisis.” His comments, made at the peak of Korea’s cultural export boom, sent shockwaves through the industry but they were grounded in data. HYBE had already detected early warning signs, including the slowdown of major IP activity, the lack of new breakout stars, and stagnating global streaming growth.

HYBE’s Strategic Approach to the Sustainable Growth of K-pop

To establish K-pop as a genre with consistent, long-term global demand rather than a passing trend HYBE has pursued three core strategic solutions. The first is a “multi-home, multi-genre” strategy. The “multi-home” approach involves localization strategies tailored to the culture and characteristics of each market. HYBE has complemented this with a multi-genre strategy built on fandom. By framing the K-pop fandom business model as a methodology, HYBE has applied it to other genres with notable success. One example is the multinational girl group KATSEYE. Following their global debut in 2024, their title track “Touch” was selected by the UK’s NME as one of the “50 Best Songs of the Year,” and their May 2025 release “Gnarly” entered the U.S. Billboard “Hot 100” and the UK Official “Singles Top 100” charts for eight consecutive weeks. Their North American tour across 16 cities also sold out, drawing extensive coverage from U.S. and Korean media. This demonstrates that HYBE’s fandom-centered approach known as the “K-Approach” can resonate even in the global mainstream market.

The second is a multi-label system built on healthy and efficient operations capable of continuously producing super IP. HYBE enhances operational efficiency by integrating infrastructure such as distribution, touring, and media, while also ensuring creative autonomy at the label level to maintain brand differentiation. The same model HYBE has used to expand domestic labels like BIGHIT MUSIC, BELIFT LAB, SOURCE MUSIC, PLEDIS Entertainment, KOZ ENTERTAINMENT, and ADOR is being applied to the U.S., Japanese, and Latin American markets, enabling the company to build a diverse artist portfolio and support locally distinctive fandoms.

The third is expanding the fan experience. A key example is the digital platform Weverse, which integrates all fan-artist touchpoints. By centralizing community, content consumption, and communication into a single platform, HYBE has deepened the fan-artist relationship, achieving meaningful outcomes. Today, Weverse has established itself as a leading fandom platform, with approximately 12 million monthly active users across 245 regions worldwide. This model, which positions fans as co-creators of content rather than passive consumers, is now drawing attention in the global music industry.

Securing Leadership as a Local Player in the Global Market

HYBE has moved beyond simply exporting K-pop and is now pursuing strategies to establish itself as a leading local player in global markets. In the United States the world’s largest music market the company has entered the mainstream network through local label acquisitions and joint ventures. In Japan the second-largest music market HYBE advanced into the music solutions business ahead of competitors, rising to become the third-largest player in the Japanese music solution industry. Fundamentally, the multi-home, multi-genre strategy is an effort to turn major music markets such as the United States, Japan, and Latin America into “home markets,” to facilitate growth beyond the limitations placed by a having a small domestic market. Meanwhile, these efforts reflect a broader effort to secure leadership not just within the relatively limited genre of K-pop, but also across mainstream genres such as pop, Latin, country, and hip-hop. At the foundation of this strategy lies HYBE’s philosophy of the “K-Capital Play” the idea that content produced overseas can still be considered “ours” as long as it is created with “our capital.” By leveraging powerful local networks in global markets and combining investment with business operation know-how and local networks, HYBE has developed a unique global expansion model aimed at gaining leadership within local markets as a local player.

Despite many domestic and international challenges, HYBE continues enhance added value to its content. Looking ahead, it is expected that HYBE will make practical contributions that allow other K-culture companies, including K-pop, to benefit positively in the global market and generate diverse synergies by utilizing HYBE’s infrastructure, ultimately enhancing the global standing of K-culture.

Eun-mi Rhee CEO of Toss Bank

The number of internet-only banks worldwide has grown fivefold in the past decade. In South Korea, the mobile-centered financial services market is expanding rapidly. Toss Bank, the latest of the country’s three internet-only banks to launch, began operations in October 2021. In just over three years, it achieved profitability and secured a customer base of 13 million, firmly establishing itself as a leading player in the first-tier banking sector. Despite the intense competition, Toss Bank is shaping the future of digital banking through a distinctive approach.

Innovation Starts with the Customer

Toss Bank’s approach to innovation is straightforward: Address every problem from the customer’s point of view. For instance, while most banks pay interest on fixed dates, Toss Bank introduced a feature that allows users to receive their interest as soon as they click. The bank also developed a real-time notification service for property registration changes, helping prevent rental fraud, and launched a collaborative loan product in partnership with Kwangju Bank. Other offerings, such as its personalized savings tool, have gained popularity across all age groups by blending finance with practicality and fun.

The bank also benefits from strong technological capabilities. It has developed its own Fraud Detection System (FDS), remote identity verification tool, and the Toss Scoring System (TSS), all of which enhance financial accessibility. Internally, it operates through an agile structure that minimizes barriers between IT, planning, and product teams, allowing for faster execution. The work environment is also designed to help employees stay focused and motivated.

A Bold New Vision for Finance

Toss Bank’s rapid rise, accomplished in just three years and nine months, is grounded in innovation, customer trust, and a focus on sustainability. The bank has implemented customer-centered operations through key initiatives such as acquiring ISMS (Information Security Management System) certification, running a 24-hour call center, and launching South Korea’s first bank-led financial fraud compensation program. These efforts have earned the bank several honors, including being named Korea’s top bank by Forbes (2023–2025), the Asia-Pacific’s best bank by CNBC (2024), and first in the internet-only banking category of the National Customer Satisfaction Index (NCSI).

Although internet-only banks account for less than 10% of South Korea’s total banking market, this leaves ample room for growth. As Toss Bank enhances its current offerings and prepares to launch new services such as mortgage loans, foreign exchange remittances, and fund sales, further expansion is expected.

Toss Bank’s long-term goal is to create an inclusive financial platform accessible to all. To this end, the bank is refining its personalized services and exploring global expansion strategies to apply its successful digital model abroad. Despite its short history, Toss Bank is already redefining what modern finance can look like and is actively building the future of digital banking.

Dong-jin Hyun Head of Robotics LAB, Hyundai Motor Group

Various challenges such as an aging society, safety concerns, and labor shortages are emerging across spaces in our daily lives, including hospitals, offices, logistics centers, and residential buildings. Robotics is rapidly gaining attention as a solution to these social issues.

The Evolution of Robotics as Physical AI on Site

Robotics is not just a robot manufacturing industry. It is a convergence of hardware, software, and service solutions, a platform that opens new businesses and ultimately an activity that implements services used in various spaces and develop society. Therefore, the goal of robotics should not be high-end yet impractical technology, but technology that is both accessible and applicable in real-world.

To this end, Hyundai Motor Group Robotics LAB has been developing products that can be applied to both industry and daily life. The industrial wearable robot “X-ble Shoulder” reduces the burden of the musculoskeletal strain of workers, while the “X-ble MEX” medical rehabilitation robot and the “Automatic Charging Robot (ACR)” equipped with barrier-free technology solve the inconvenience of the weak.

In this practical philosophy, Robotics LAB’s mobile robots are focusing on embedded AI a technology that works even if the internet is cut off and responds immediately in the field. When embedded AI is combined with perception AI through sensors, it becomes physical AI, which embeds learned AI and combines service interfaces, enabling robots to act as interactive entities within their environment.

Service Innovation Connecting Work and Daily Life

The Robotics LAB is also actively developing user-customized automated mobile services that combine robot autonomous driving with service networks. Robot delivery, EV charging, patrol and guidance services are already in the pilot stage. “Fleet Manager” platform enables real-time control and management of both robots and services which is integrated with payment systems and building infrastructure.

Close-to-life services have also become a reality. Robots are now capable of tasks such as restocking convenience store shelves, organizing displays, carrying boxes, serving beverages etc. In industrial settings, dual-arm mobile robots are replacing repetitive tasks and improving the efficiency of quality control. The small mobility platform “MobED 2.0” which is scheduled to be released at the end of the year is expected to expand to various industries and aspects of daily life.

After all, the core of robotics business lies in the value of its technology. What matters is not a list of technical features, but where and how the technology is used proves the scalability of the technology. Based on the accumulated data, Robotics LAB plans to jump-off to a global robotics platform company with “affordable prices and usable technologies.”

Joey Choi Vice President of SAMG Entertainment

SAMG Entertainment, the creator of beloved animated IPs such as Miniforce and Catch! Teenieping, topped both the KOSPI and KOSDAQ with a staggering 621% stock price increase in the first half of 2025. As a leading Korean content IP company, SAMG has succeeded in capturing audiences across all age groups, from children to adults. This article explores the business strategies behind its rise.

Transforming the Business Model Through Proprietary IP Development

The main consumers of character merchandise the MZ generation have recently embraced trends such as random boxes and gacha-style collecting, fueling a transformation in consumer behavior. This collectible-driven purchase structure has powered the rapid growth of Asian character brands like Japan’s Bandai and China’s Pop Mart. By adopting this model, SAMG Entertainment saw its stock price surge by approximately 800% in just one year. In the first half of 2025 alone, it achieved a 621% increase, outpacing K-beauty and defense stocks to rank first on both major Korean indices.

This dramatic success is rooted in hard-earned lessons. Founded in July 2000 as SAMG Animation, the company steadily built its portfolio but endured two decades of losses. The turning point came when it failed to profit from the global hit series Miraculous: Tales of Ladybug and Cat Noir, because it lacked ownership of the IP. Learning from this, SAMG began developing its own IP and expanded into toy manufacturing and distribution, starting with Miniforce.

Catch! Teenieping, the company’s flagship 3D animation IP, is a magical girl series infused with a Pokémon-style collection system. In Korea alone, over seven million Teenieping figurines have been sold. On average, each viewer in the show’s core demographic girls aged four to seven owns about ten figurines. Characters from various kingdoms tap into both children’s and parents’ instinct to collect, demonstrating how fandom can become a powerful economic force.

From Kids’ Content to a Family Brand

SAMG has intentionally positioned Catch! Teenieping as more than just children’s content. Emotional depth was carefully designed to resonate with adults as well. The 2024 film Heartsping: Teenieping of Love drew 1.25 million viewers, making it the second-highest grossing Korean animated film of all time. While the box office revenue was modest relative to its viewership, the Catch! Teenieping franchise gained widespread visibility through social media algorithms, introducing itself naturally to Gen Z and millennials. This broader appeal led to collaborations with brands such as Hyundai Motor Company, SM Entertainment, the Kia Tigers, Clio, CU, Cookie Run, and KB Kookmin Card, transforming Catch! Teenieping into a beloved brand across generations.

Evolving from a first-generation animation studio into a content company with a robust One Source Multi Use (OSMU) business model, SAMG now sees this moment as a pivotal opportunity for global expansion. The company is preparing to scale internationally, aiming to further enhance profitability and establish its proprietary IPs on the global stage.

Mi-sun Song CEO of Hanatour

Prior to the COVID-19 pandemic, Hanatour was firmly established as the leading travel agency in Korea. One out of every five travelers departing from Incheon International Airport was a Hanatour customer, and the company held a 36% share of the package tour market. Over the past 25 years, the Korean travel industry grew at an average annual pace of 12% but Hanatour recorded annual growth figures of 21%, scaling up by 65 fold. However, the company’s revenue effectively fell to zero with the pandemic in 2020. Despite facing this global crisis and profound uncertainty, Hanatour renewed its brand and service, initiating a new phase of growth.

Strategic Decisions Amid the Pandemic

Faced with an unprecedented collapse in revenue, Hanatour implemented internal countermeasures such as real estate sales and capital increases through rights offerings which proved to be insufficient against the broader impact of the pandemic. When the global travel market had come to a standstill, the company made a critical decision: We will not remain idle. It began developing concrete scenarios for the reopening of the market in the endemic era. The company zeroed in on a central question: What kind of travel, and in what form, should we offer customers? Resolving to strengthen its core competency in travel, Hanatour rebranded its CI and slogan in 2021, making new strides toward fulfilling travelers’ dreams.

The crisis would be treated as an opportunity to overhaul the company’s infrastructure and prepare for the market’s eventual recovery. The next-generation systems were upgraded and the workforce was brought back one year ahead of competitors, in October 2021. Digital communication strategy shifted toward bold, high-impact initiatives designed to promote the brand organically across social media. New travel products were developed based on customer demand, with a focus on the essence of travel itself. These included “Hana Pack 2.0,” which eliminated unpopular group shopping components; “My Way,” which allows customers to select their own flights and hotels; and “Just Us,” a private, fully customized package product. Hanatour actively responded to evolving travel demand by reforming its system, human resource, and brand. The market response was overwhelmingly positive. For example, despite its premium pricing, Hana Pack 2.0 received a strong reception, contributing to a 49% year-on-year increase in operating profit in 2024.

Becoming a Global Brand Chosen by Travelers Worldwide

Hanatour believes that Southeast Asia is poised to follow a similar growth trajectory to Korea’s travel market. Based on this view, the company is implementing a strategy to transfer its experience and infrastructure to local markets, beginning with establishing a subsidiary in Singapore. The company is also investing into operational innovation through AI adoption. Its goal is to standardize internal competencies by converting the travel planning process, traditionally labor-intensive and experience-driven, into one based on large language model (LLM) AI.

Having successfully navigated the pandemic, Hanatour’s recovery has resulted in a fundamental transformation. Now repositioned as a customer experience-centered platform company, Hanatour is preparing for its next journey: becoming a brand selected by travelers around the world.