Trump Administration 2.0: The First 100 Days

Policy Directions and Future Outlook

for Trump’s Second Term

By Tae-kyu Lee, Research Fellow, Korea Economic Research Institute

1. Economy and Trade

-Increase tariffs on unfair and unbalanced trade, establish an External Revenue Service to collect tariffs, and review existing trade agreements.

-Impose additional tariffs based on the International Emergency Economic Powers Act (IEEPA): 25% on Canada (10% on energy), 25% on Mexico, and 20% (10% + 10%) on China.

-Apply a 25% tariff on all steel imports and abolish existing alternative agreements such as quotas and exemptions. Impose a 25% tariff on aluminum (up from 10%) without exemptions.

-Promote reciprocal trade and tariff policies to eliminate asymmetric tariffs with trade partners and address unfair trade practices and non-tariff barriers.

-Relax the Treasury Department’s criteria for currency manipulation designations and expand the list of countries monitored for currency manipulation.

2. Foreign Affairs and Security

-Pursue an “America First” foreign policy by rejecting multilateralism, including withdrawal from the UN Human Rights Council (UNHRC), the United Nations Relief and Works Agency for Palestine Refugees (UNRWA), and the World Health Organization (WHO).

-Focus on national interest-based foreign policy and overhaul the United States Agency for International Development (USAID).

-Pursue a new expansionist strategy to expand the US’ geopolitical influence, including demands to purchase Greenland, claims of ownership over the Panama Canal, control of the Gaza Strip, and a proposal to rename the Gulf of Mexico.

3. Industry and Innovation

-Promote comprehensive innovation policies to strengthen AI industry leadership, including lifting Biden administration regulations, establishing the Presidential Council of Advisors on Science and Technology (PCAST), creating a federal sovereign wealth fund, and launching the Stargate project involving big tech companies.

-Strengthen international leadership in digital financial technologies, including cryptocurrency, and consider cryptocurrency reserves as a strategic national asset.

4. Government Reform

-Implement large-scale government reform (streamlining organizations, rationalizing budgets, maximizing productivity) through the Department of Government Efficiency (DOGE).

-Offer early retirement packages to federal employees and end remote work, aiming to cut $1 trillion in federal spending by July 2026.

5. Environment and Energy

-Declare a national energy emergency and promote the development of fossil fuels (especially in Alaska) and nuclear power to achieve low energy costs and strengthen the competitiveness of the US energy and manufacturing industries, while repealing related environmental regulations.

-Repeal Biden administration’s climate and energy policies (such as the IRA and Green New Deal), halt wind power projects, eliminate electric vehicle mandates, and withdraw from the UN Paris Agreement.

6. Immigration and Society

-Strengthen border control to prevent illegal immigration, intensify criminal enforcement against undocumented immigrants, and prohibit them from receiving public benefits.

-Eliminate Political Correctness (PC) ideologies, such as Diversity, Equity, and Inclusion (DEI), from key social sectors including education, government, sports, and the military, and ban gender transition procedures that use chemical or physical methods for minors under 19.

Since President Trump’s inauguration on January 20, the US has been pursuing rapid changes in domestic and foreign policy. On the first day of his term, approximately 100 executive orders and memoranda were announced, and the number of executive orders signed within the first month increased nearly fivefold compared to the same period in Trump’s first term. President Trump has been swiftly implementing his “America First” campaign promises to present a bold policy agenda across all areas of governance. With significant reverberations being felt not only in the US but also across the global order, this report examines the key policy directions of Trump’s second term, focusing in detail on trade policies that are expected to have the greatest impact on the Korean economy.

Impact of Trump’s Second-Term Trade Policies

Unlike Canada, Mexico, and China, South Korea has not yet been directly targeted in tariff disputes. However, considering the significant recent increase in South Korea’s trade surplus with the US, it may be difficult for South Korea to avoid becoming a target of the Trump administration’s trade policies. After the April 1 deadline for submitting reports on trade issues specified in the presidential memorandum on “America First Trade Policy,” more concrete trade measures against South Korea are expected to emerge. The general impact of the announced tariff policies so far can be outlined as follows:

Tariffs on Canada, Mexico, and China

Korean companies that have expanded into Canada and Mexico to benefit from the USMCA will face direct repercussions. In particular, Korean automakers operating in Mexico are heavily reliant on the US market for sales, making them highly vulnerable to increased tariffs on Mexican exports to the US. In 2023, Korean automakers’ sales in Mexico amounted to approximately $12.4 billion, with a substantial portion of that figure likely to be affected by tariffs. Meanwhile, US tariffs on these three countries will also have an indirect impact on South Korean exports. A decline in Canadian, Mexican, and Chinese exports to the US will reduce demand for South Korean intermediate goods, causing indirect damage. The extent of this impact will depend on the degree of South Korea’s participation in the global value chain (GVC) of these countries’ exports to the US. Since South Korea’s GVC contribution to China is significantly higher than its contribution to Canada and Mexico, the indirect damage from Chinese trade restrictions is expected to be much larger than from Canadian or Mexican restrictions.

Reciprocal Trade and Tariffs

From a tariff standpoint, about 98% of goods traded between South Korea and the US are currently duty-free, so South Korea is unlikely to be directly affected by reciprocal tariffs. However, Trump’s broader “reciprocal trade” agenda is expected to involve pressure on trading partners over not only tariffs but also other unfair trade practices and regulations. One notable example is the value-added tax (VAT). Trump has argued that since the US does not have a VAT, it effectively serves as an additional tax on American exports. Based on this logic, the US could impose tariffs or other trade measures in response. While the US imposes a sales tax (which varies by state) rather than a VAT, most sales tax rates are below 10%, significantly lower than the over 20% rates seen in many European countries.

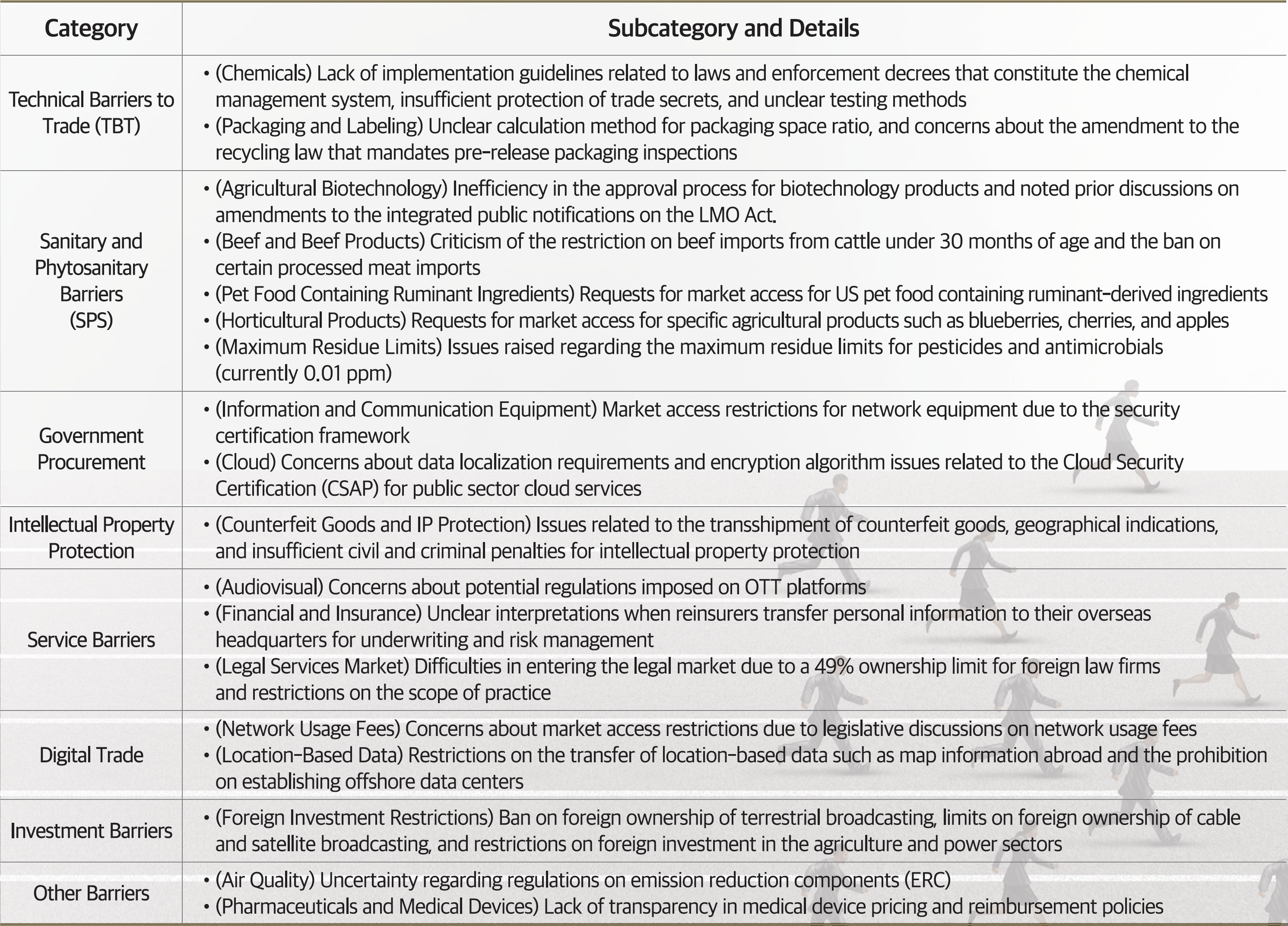

Since South Korea’s VAT is 10%, lower than those of most major advanced economies, the VAT itself is unlikely to become a major source of conflict with the US. However, South Korea’s non-tariff barriers could become a key issue. The US Trade Representative (USTR) publishes an annual National Trade Estimate (NTE) report listing the non-tariff barriers of each country. The 2024 report highlights various non-tariff barriers in South Korea, including technical and service barriers, as well as intellectual property protection issues. Therefore, the US is likely to demand the removal of these non-tariff barriers under the principle of reciprocal trade. Since many of these non-tariff barriers are rooted in domestic legislation, removing them would require amendments to South Korean law. Given the political realities in South Korea, it is unlikely that a bipartisan legislative amendment will materialize swiftly. As a result, friction over non-tariff barriers is expected to persist in the future.

Trade Barriers Report 2024 (Korea Section)

Steel and Aluminum Tariffs

The Trump administration abolished the existing exemptions and alternative agreements for steel, aluminum, and derivative products as of March 12, imposing a uniform 25% tariff on steel and increasing the aluminum tariff from the existing 10% to 25%. In 2024, the US accounted for 13.1% of Korea’s steel exports and 10.5% of Korea’s aluminum exports. The burden is particularly higher for steel exports that were previously exempt from tariffs under the quota system. For aluminum, while the increase is 15%p, the actual burden rises to 25%p for companies that previously benefited from tariff exemptions. Since the tariffs apply to all countries, performance in the US market will depend on relative competitiveness. In terms of price, Korea maintains moderate price competitiveness with the average unit price for steel being $1,135 per ton, lower than the overall average of $1,310 per ton (Source: Steel Import Monitoring and Analysis System). Compared to the higher average prices in the EU, UK, Japan, and Canada, Korea is expected to maintain its competitiveness even after the tariff increase.

Outlook and Policy Implications

The core of Trump’s second-term economic policy is trade policy, as the “America First” principle is most clearly reflected in international trade. The comprehensive and detailed outline of Trump’s second-term trade policy is expected to emerge in April, once investigations into unfair trade practices are completed. Tariffs on Canada, Mexico, and China have been imposed for non-economic reasons such as illegal immigration and drug trafficking. Therefore, except for China, these tariffs may not last long depending on the efforts and negotiations of the respective countries to address the underlying causes. Since Canada and Mexico are deeply integrated into the US supply chain, high tariffs on these two countries would directly harm the US economy. This is why the US postponed the imposition of auto tariffs on Canada and Mexico for one month on March 5 at the request of the industry. This essentially extends the negotiation period, and considering the potential damage to the US, some form of agreement is likely.

Starting in April, tariffs are expected to be imposed on European countries, Korea, Japan, and Southeast Asian countries with trade surpluses with the US. The level of pressure the US applies will vary by country, depending on both economic and non-economic factors. However, the trade measures to be announced by the US in April are not final. The final version will be determined through negotiations with individual countries, which could involve considerable friction depending on the country. For Korea, the trade surplus with the US has steadily increased over the past five years (2020–2024), and the surplus in 2025 is expected to increase by about 336% compared to 2020. As a result, there is a high likelihood of tariff increases on major surplus items and a renegotiation of the Korea-US FTA.

Future trade negotiations with the US should be linked to the establishment of a new trade strategy for Korea. Although the extent may vary, the protectionist trend in the US is expected to persist beyond Trump’s second term, as protectionism appeals to voters. Therefore, Korea needs to both invest within the US to mitigate the effects of protectionism and strengthen the multilateral trading system. In this context, actively pursuing membership in the CPTPP is necessary. Strengthening the multilateral trading system can serve as leverage to facilitate negotiations with the US. At the same time, Korea should strengthen cooperation with the US in strategic industries such as semiconductors, batteries, shipbuilding, and biotechnology. It is essential for the US to maintain technological superiority in advanced strategic industries in its competition against China, which means that cooperation with allied countries is an important priority. Korea’s significant global competitiveness in semiconductors, batteries, shipbuilding, and other strategic industries provides a considerable advantage in trade negotiations with the US. By strengthening supply chain connectivity with the US in these strategic industries, Korea can significantly reduce the impact of US protectionism.

To make such a trade strategy effective, securing industrial competitiveness is essential. Without the ability to “replace others” or avoid being “replaced by others,” it will be difficult to survive in an era of protectionism and cooperate strategically with the US. Therefore, now is the time for systematic industrial policies to strengthen and maintain industrial competitiveness. Industrial policy, once disregarded by mainstream economics, has now emerged as a key economic policy in the era of protectionism. Korea’s position in the global market will be determined by the success of its industrial policy. Most major countries are already implementing large-scale industrial policies to reorganize supply chains, foster strategic industries, and develop AI. However, as seen from the experience of many countries, successful industrial policy is not easy to achieve. Now is the time for the Korean government and industry to work together to develop a smart trade strategy and secure industrial competitiveness to navigate the challenges of Trump’s second term.