Newsroom > Press Releases

Newsroom

Press Releases

press

Korea-U.S. Cooperative Measures in Shipbuilding

- Date : 2025-05-19

- Views : 69

U.S. expected to order up to 448 new ships by 2037;

Must draw up measures to negotiate a win-win outcome

[Research & Analysis on the U.S. Shipbuilding Industry:

Implications for ROK-U.S. Shipbuilding Cooperation]

- [U.S. strategy] Establish cooperative initiatives: Executive orders reestablishing U.S. shipbuilding infrastructure

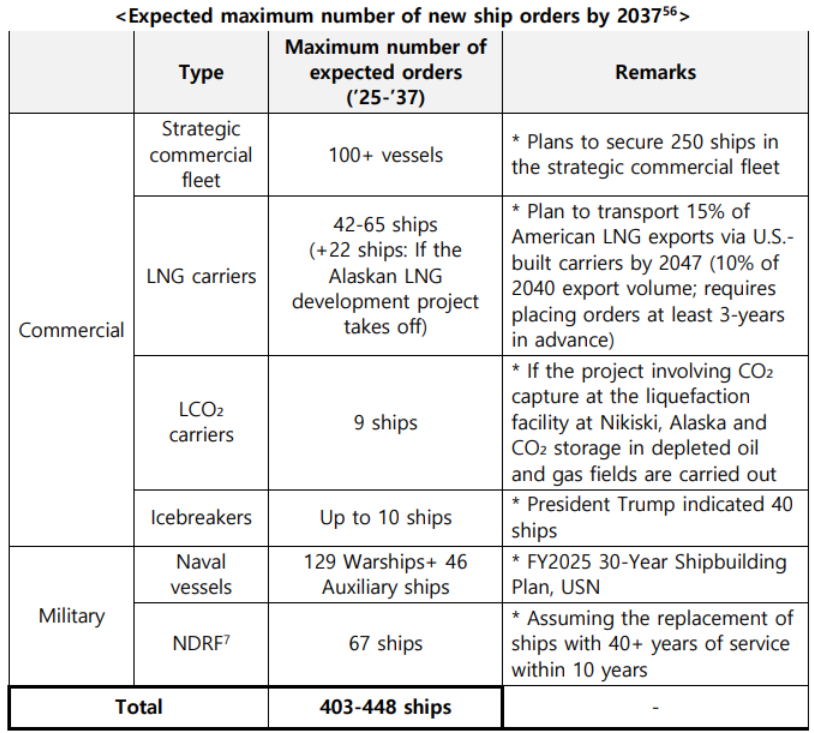

- [U.S. market] U.S. policy to rebuild the maritime industry: Between 403 to 448 new ship orders expected to be placed by 2037

- [Policy tasks] ① Create policy responses to align with U.S. plans for new construction of vessels in each ship category

* Priority considerations: Local production of LNG carriers in the U.S.; focus on MRO(Maintenance, Repair and Operations), transports and landing ships for naval vessels; establish a ROK-U.S. Joint Fund for next-generation ships

② Review: Ease restrictions on shipbuilding technology exports; draw up measures to expand Korean shipbuilding workforce

③ Shipbuilding industry competitiveness: Focus on next-generation ships

Amid the U.S. policy drive to rebuild the maritime industry, there are calls for the Korean government and shipbuilding industry to identify and pursue negotiations with the U.S. to secure participation in promising industrial areas, including new construction of LNG carriers and commercial vessels, MRO for Navy vessels, and cooperation in next generation ships.

The Federation of Korean Industries (“FKI”) commissioned Korea Maritime & Ocean University Professor Min-cheol Ryu in publishing the “Research & Analysis on the U.S. Shipbuilding Industry: Implications for ROK-U.S. Shipbuilding Cooperation” report, recommending measures for ROK-U.S. shipbuilding industry cooperation.

Trump signs EO 14269 (Restoring America’s Maritime Dominance)

The report outlines the Trump administration’s plans to obstruct China’s march toward gaining a maritime dominance. The U.S. plans include cooperating with Korea and other allies to address demand for LNG carriers, commercial vessels, naval vessels, etc. and spurring investment in the U.S. to rebuild the American maritime industrial base. On April 9, President Trump signed the executive order, ‘Restoring America's Maritime Dominance (EO 14269)’. The highlights of the executive order include initiatives such as drawing up the Maritime Action Program (MAP)1, establishing the Maritime Security Trust Fund2, reducing (maritime) dependence on adversaries through allies and partners, imposing sanctions on PRC (People’s Republic of China)-built ships and related equipment, and expanding the fleet of commercial vessels trading under the flag of the U.S.

In accordance with the executive order, the USTR announced measures to impose additional fees on vessels owned by PRC shipping companies or shipowners as well as vessels built by the PRC on April 17.

1) A general action plan to revitalize the U.S. maritime industry

2) A vehicle for providing supportive funding as indicated by the Maritime Action Program

The U.S. is expected to order up to 448 new ships by 2037

The SHIPS for America Act, proposed in April 2025, stipulates that a strategic commercial fleet3

flying the U.S. flag will be increased to 250 ships and that 15% of LNG exports shall be transported by U.S.-made vessels by 2047. In addition, the U.S. Navy issued its FY2025 30-Year Shipbuilding Plan, which includes plans for new construction of a total of 364 new combat and logistics vessels. Moreover, President Trump announced that 40 icebreakers will be newly ordered in January.4

The FKI-commissioned report projects that as a result of the U.S. maritime industry rebuilding policy, there will be between 403 to 448 new orders for vessels, including commercial vessels, LNG carriers, and Navy vessels by 2037.

3) Privately-owned marine vessels that meet national security requirements, engaged in international trade, and are militarily useful

4) “President Trump Announces America Will Order 40 Big Icebreakers”, Forbes, 2025.1.28

Employ differentiated measures by vessel category (LNG carriers, commercial vessels, military vessels, next-generation ships, etc.)

The report calls for leveraging the shift in U.S. policy to advance Korea’s shipbuilding industry through differentiated strategies by vessel category: LNG carriers, commercial vessels, military vessels, next-generation ships.

5) Subject to change according to policy shifts, including in budget, politics, and environmental considerations as well as U.S. workforce development and infrastructure factors

6) Estimated by Professor Ryu based on available U.S. public records

7) National Defense Reserve Fleet : Ships under the U.S. flag that provide support to the U.S. military during wartime or national emergency

For LNG carriers, it may not be realistic to fulfil the entire order for newly built LNG carriers locally in the U.S. However, Korean shipbuilding companies should prepare for the medium- to long-term scenario in which LNG carriers will be locally built in the U.S. The report added, since the strategic commercial fleet consists mostly of mediumsized vessels8, it is also necessary to draw up public-private cooperation measures to provide Korean medium-sized vessel shipbuilders with opportunities for new construction orders and business expansion.

According to the report analysis, it is unlikely that in the short term, Korean companies would receive orders for MRO and combat vessel-related work, as they are closely integrated with advanced weapons systems. Therefore, Korean companies should embark on confidence and trust building efforts by focusing on vessel structural body MRO, then gradually bridging out to contracted projects on structural body repair and overhaul. Over the long term, Korean companies may eventually participate in MRO contracts that include weapons systems.

The report also recommended that the focus should be on transports and support ships and auxiliary ships for new construction of U.S. Naval vessels. To strengthen capacity for exporting military vessels, the report highlighted the need to advance the overall competitiveness of Korean warships and weapons systems.

Regarding next-generation ships, the report proposed giving consideration to establishing a ROK-U.S. Joint Fund to support research and commercialization of advanced technologies, targeting medium to large-scale CO₂ carriers, liquid hydrogen carriers, autonomous vessels, etc.

8) Oil tankers in the range of 10K-125K DWT, container ships in the 1K-6K TEU class, LPG carriers with a capacity between 5K-65K ㎥, etc.

Facilitation measures must be continually driven forward to rebuild the U.S. maritime industry ecosystem

On rebuilding the U.S. maritime industry ecosystem, the report’s view was that considerable investment over the long term is required to improve infrastructure, enhance productivity and expand the industry’s workforce, etc.

The report emphasizes clear definition of financial support for shipyard acquisitions in the U.S. and business investments support into shipbuilding tools, machinery, and equipment. The Korean and U.S. governments also need to engage in prior dialogue on measures to improve U.S. shipyard productivity and renovating shipyard sites and their nearby infrastructure.

With acquisitions of U.S. shipyards, the report highlighted the need for long-term workforce development planning for the Korean shipbuilding industry to address a potential escalation of domestic workforce shortages, which may intensify due to personnel movement to the U.S. In the short term, the report recommended fulfilling a certain order volume of LNG carriers and icebreakers in Korea, providing U.S. personnel with limited experience in newly building these ship types to participate in these projects, contributing to broadening their expertise. The report also proposed giving consideration to hiring retired Korean shipbuilding experts in U.S. shipyards.

The report also noted the need to consider measures to ease regulatory restrictions on exporting shipbuilding technologies9—excluding key technologies—to facilitate the smooth entry of Korean shipbuilders into the U.S.

Professor Ryu stated, “When Korean shipbuilders engage in business in the U.S., they must jointly develop strategies with both state and federal governments to secure workforce and broaden supply chain foundations. Continued dialogue between the two countries is also essential to ensure consistency in U.S. policy support. Moreover, a thorough review business risks that may stem from shifts in U.S. policy stance is necessary.”

9) A review of whether to permit the export of design and construction technologies when shipbuilders engage in overseas cooperation

Must engage in sustained efforts to bolster maritime industry competitiveness, including boosting support for next-generation ships

The report called for establishing a shipbuilding research organization, etc. to pursue sustainable development in the Korea shipbuilding industry.

Amid growing requests for overseas cooperation in shipbuilding, including from the U.S. and India, there is a rising need to establish a comprehensive strategy to nurture the shipbuilding industry. This would require input from various stakeholders, including players in the diplomatic, trade, industry, energy, logistics, finance, and other fields. Thus, the report proposes that consideration be given to establishing a research organization focused on the shipbuilding industry.

Sang-ho Lee, vice president of Economic and Industrial Research, stated: “There is renewed focus on enhancing global competitiveness in the Korean shipbuilding industry with the U.S. policy to rebuild its maritime industry. The Korean legislature and government must strengthen support for next-generation ships, including autonomous and hydrogen-powered vessels, while also driving productivity gains by supporting smart shipyards.”