Newsroom > Press Releases

Newsroom

Press Releases

press

The Effects of the Trump Administration’s Tariff-based Policies and Korea’s Response Measures

- Date : 2025-06-10

- Views : 186

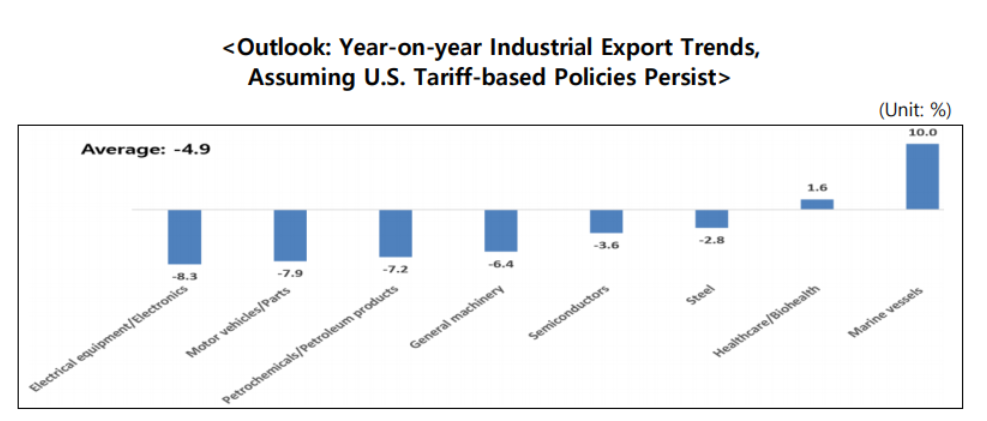

2025 exports expected to drop by 4.9%

with persisting U.S. tariff-based policies

[Survey: The Effects of the Trump Administration’s Tariff-based Policies

and Korea’s Response Measure Policy Tasks]

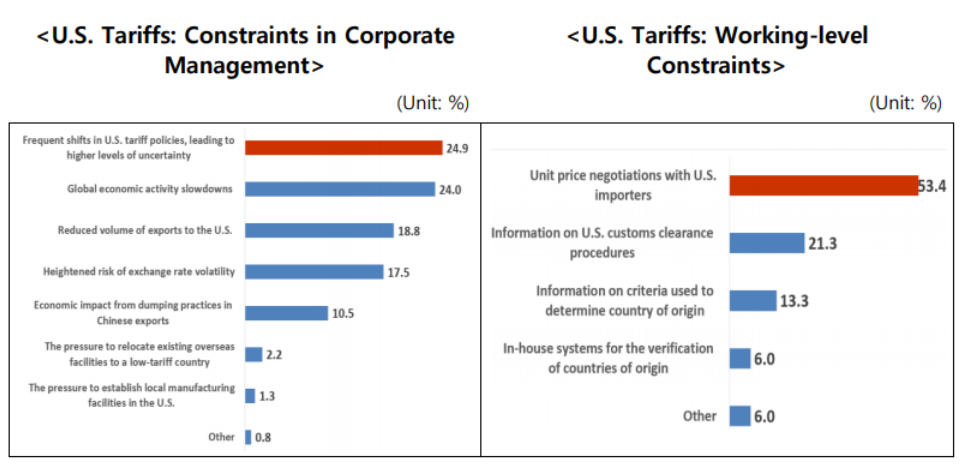

- [Constraints] ①Frequent shifts in U.S. tariff policies (24.9%),②Deterioration of global economic activity (24.0%)

- [Business outlook] 4.9% trade reduction; 6.6% drop in revenue; and 6.3% lower operating profits

* Exports (%):

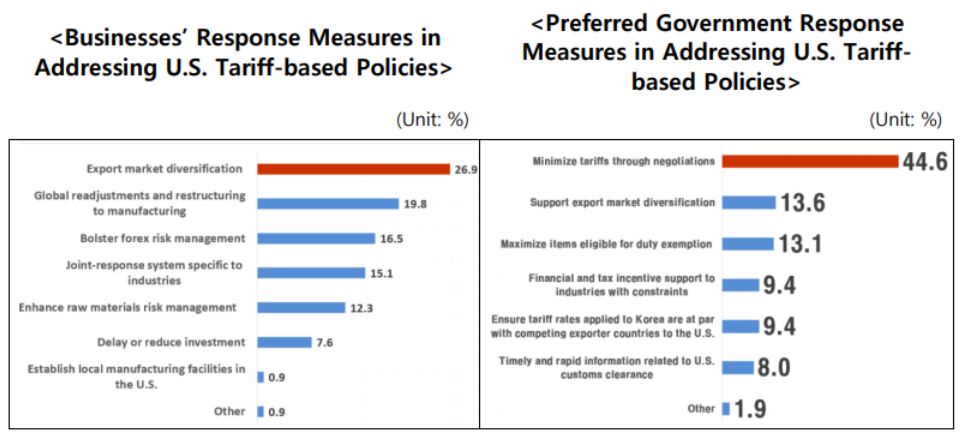

- [Policy tasks] ①Negotiate minimization of tariff rates (44.6%), ②Support export market diversification (13.6%)

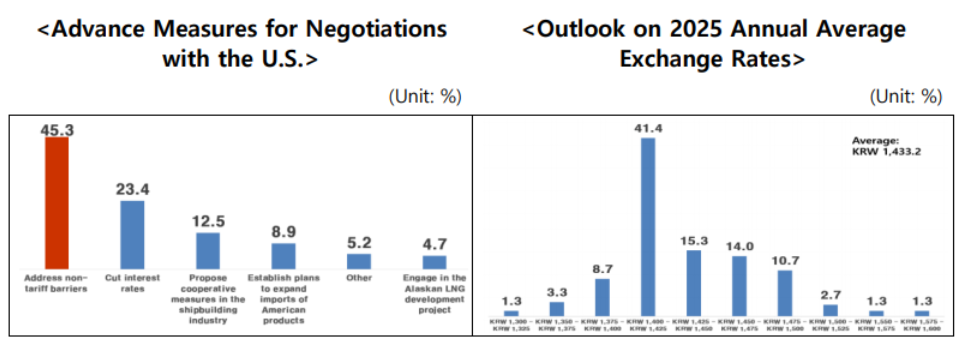

- [Negotiation approaches] ①Make committed efforts toward addressing non-tariff barriers (45.3%), ②Interest rate cuts (23.4%)

- [Outlook] The tariff dispute will persist for 6+ additional months, affecting both U.S. and Korean businesses negatively

Businesses expressed concern over frequent shifts in U.S. tariff policies may lead to higher levels of uncertainties and the tariff dispute resulting in global economic activity slowdowns. In response, there are growing calls for the Korean government to engage in negotiations with the U.S. to successfully minimize U.S. tariff rates on Korean exports by committing to address non-tariff barriers, etc.

Businesses’ top working-level constraints:

Negotiating unit prices with U.S. importers

The Federation of Korean Industries (“FKI”) commissioned Mono Research, a market research institution, to conduct The Effects of the Trump Administration’s Tariff-based Policy and Korea’s Response Measure Policy Tasks survey, targeting the top 1,000 exporting Korean companies by revenue. The survey revealed that businesses’ top corporate management constraints included, in descending order, ‣Frequent shifts in U.S. tariff policies leading to higher levels of uncertainty (24.9%), ‣The tariff disputes resulting in global economic activity slowdowns (24.0%), ‣ Shrinking U.S. exports (18.8%), ‣Heightened risk of exchange rate volatility (17.5%), ‣Economic injury caused by dumping practices in Chinese exports (10.5%), etc.

Businesses’ top working-level constraints—both current and anticipated—include, in descending order, ‣Unit price negotiations with U.S. importers (53.4%), ‣Information on U.S. customs clearance procedures, and ‣Accessing detailed information on criteria used to determine country of origin (13.3%).

Outlook: With persisting U.S. tariff-based policies, exports expected to drop by 4.9%; with revenue reductions by 6.6%; and 6.3% lower operating profits

Businesses responded that with persisting U.S. tariff-based policies, 2025 exports

will drop by an average 4.9%1) compared to the previous year. A breakdown of the expected export reductions by industry are as follows: ‣Electrical equipment/Electronics2), 8.3%; Motor vehicles/Parts 7.9%; Petrochemicals/Petroleum products, 7.2%; General machinery, 6.4%; Semiconductors, 3.6%; and Steel, 2.8%. Despite the U.S. tariffs, the Marine vessels (10.0%) and Healthcare/Biohealth (1.6%) industries are anticipating export increases.

1) Criteria: Arithmetic average of responses

2) Electrical equipment/Electronics = Sum of the Display, Computers, and the Mobile telecommunications equipment industries

The survey also indicated that with persisting U.S. tariff-based policies, major Korean exporters’ revenue and operating profits would drop by 6.6% and 6.3%, respectively.

Policy tasks: Minimize tariff rates through negotiations;

support export market diversification

Businesses’ response measures in addressing the U.S. tariff-based policies, in descending order: ▸Export market diversification (26.9%), ▸Global readjustments and restructuring to manufacturing, procurement, and logistics (19.8%), ▸Bolster forex risk management (16.5%)▸Build joint-response systems to address industry-specific issues (15.1%),▸Enhance raw materials risk management (12.3%), and ▸Delay or reduce investments (7.6%).

Preferred government response measures included, in descending order: ▸Minimize tariff rates through negotiations with the U.S. (44.6%), ▸Support export market diversification (13.6%), ▸Maximize items eligible for duty exemption (13.1%), ▸Apply same tariff rates to products from competing countries (9.4%), and ▸Provide financial and tax incentive support to exporting industries experiencing constraints (9.4%).

Smooth tariff negotiations with the U.S.

require addressing non-tariff barriers

In descending order, businesses responded the Korean government should prioritize the following advance approaches to ensure smooth tariff negotiations with the U.S.: ▸ Make committed efforts toward addressing non-tariff barriers indicated by the U.S. (45.3%), ▸Implement interest rate cuts (23.4%), ▸Propose cooperative measures in the shipbuilding industry (12.5%), and ▸Expand imports of American products (8.9%).

Meanwhile, businesses anticipated an annual average KRW/USD exchange rate of

KRW 1,433.2/dollar3 in 2025. Businesses’ measures to manage KRW/USD exchange rate risk included, in descending order: ‣Adjusting import and export unit prices (22.3.%), ‣Diversification of export markets (20.8%), ‣Bolstering corporate competitiveness, including by productivity gains (19.8%), ‣Diversification of raw material and component sources (17.3%), and ‣Expansion strategy for currency hedging (10.1%).

3) Criteria: Arithmetic average of responses

Outlook: Uncertainties in global trade from U.S. tariff-based policies

will persist for 6+ additional months

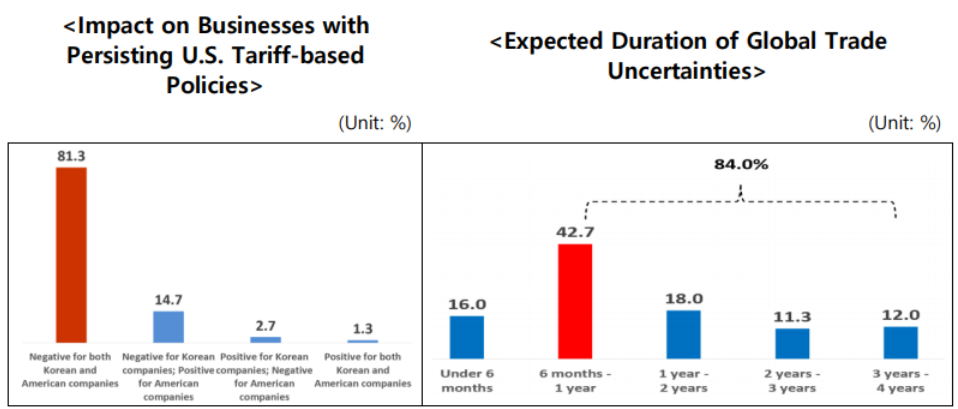

Among major Korean exporters, 8 of 10 (81.3%) anticipate U.S. tariff-based policies to affect both Korean and U.S. businesses negatively. Furthermore, 84.0% of respondents expected that the tariff disputes will persist for at least 6 months.

Sang-ho Lee, vice president of Economic and Industrial Research remarked, “The U.S. and China have recently agreed to implement lower tariff rates for a duration of time. However, the uncertainties stemming from U.S. tariff-based policies still persist--the U.S. still maintains trade deficits, the U.S. credit ratings were downgraded, and follow-up tariff negotiations have stalled. The Korean government must keep a close monitor on developments and shifts in U.S. tariff policies. At the same time, measures must be taken to address non-tariff barriers and a negotiation strategy that minimizes harm to Korean companies drawn up.”