Newsroom > Press Releases

Newsroom

Press Releases

press

February Outlook Business Survey Index (BSI) Released

- Date : 2025-01-22

- Views : 458

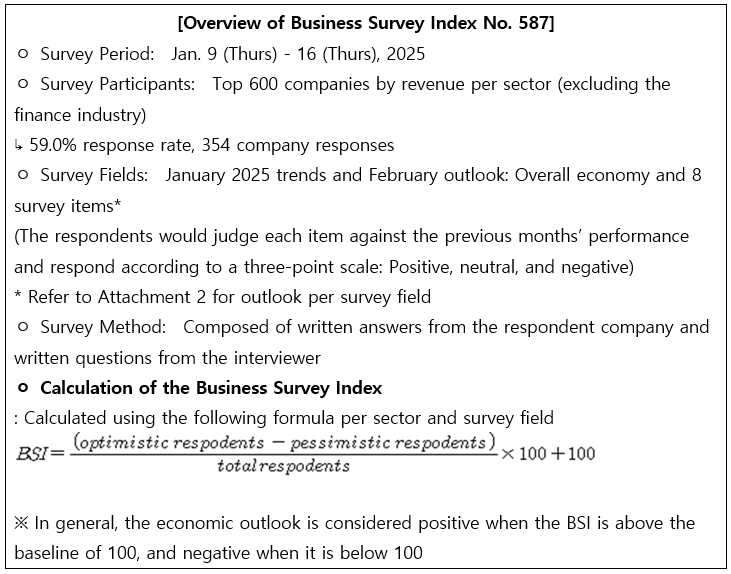

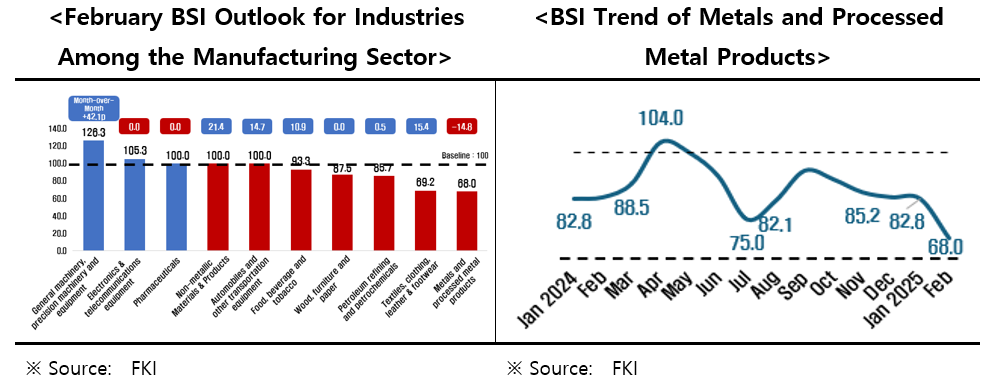

The February BSI stands at 87.0: The frozen business sentiment of January (84.6) remains

- BSI for all sectors is 87.0: 2 years and 11 months of consecutive slowdowns (below the baseline of 100), longest period of sluggishness on record

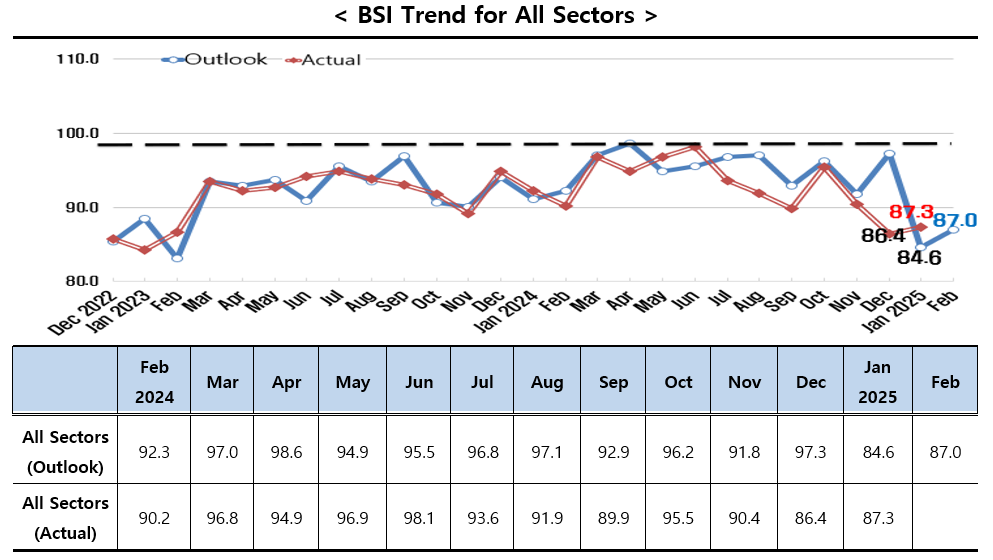

- [BSI by Sector] The manufacturing sector (93.0) and the non-manufacturing sector (81.4) both remain negative

* Non-manufacturing sector (81.4) lowest since July 2020, 4 years and 7 months ago

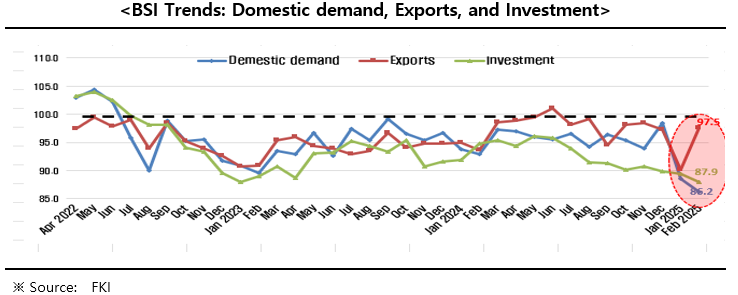

- [BSI by Survey Field] Domestic demand (86.2), Exports (97.5), Investment (87.9); These three fields have been negative for the 8th consecutive month

* Sectoral polarization: Worsening Domestic demand (88.6→86.2), vs. previous month, but rising Exports (90.2→97.5) vs. previous month

- To spur spending and investment, swift passage of legislation supporting peoples’ livelihoods and businesses are necessary

The Federation of Korean Industries (FKI)’s Business Survey Index (BSI), a survey of the business sentiment of the largest 600 Korean companies in revenue, recorded an outlook of 87.0 for February 2025, falling short of the baseline of 1001) for 2 years and 11 months since April 2022 (99.1). This is the longest-ever period of back-to-back negative BSI figures on record.

1) A BSI outlook that surpasses 100 signifies positive business sentiment for the overall economy, relative to the prior month, and vice versa.

The February BSI outlook (87.0) marks a period of 2 consecutive months of below-80 BSI figures since January (84.6). This is the first time in 2 years that the BSI remained under 80 for 2 consecutive months, since the 5-month period of below-80 BSI figures2) between October 2022 to February 2023.

2) 89.6 (Oct. 2022), 86.7 (Nov), 85.4 (Dec), 88.5 (Jan. 2023), 83.1 (Feb)

3) BSI Outlook for the Manufacturing Sector: 98.4 (Apr 2024), 95.5 (May), 95.9 (Jun), 88.5 (Jul), 94.8 (Aug), 93.9 (Sep), 96.4 (Oct), 91.1 (Nov), 89.9 (Dec), 84.2 (Jan), 93.0 (Feb)

4) BSI Outlook for the Non-manufacturing Sector: 105.1 (Jan 2024), 84.9 (Jan 2025), 81.4 (Feb)

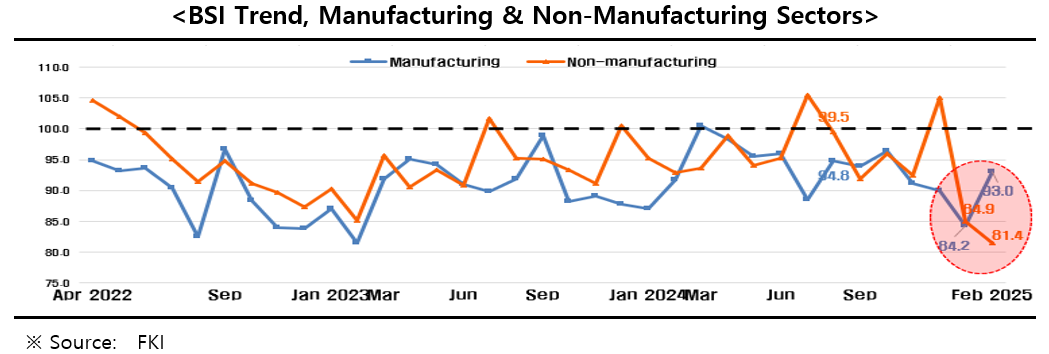

Among the 10 industries among the manufacturing sector, only ▸General machinery, precision machinery and equipment (126.3) and ▸Electronics & telecommunications equipment (105.3), which includes semiconductors, reported positive outlooks. As such, the FKI expects that last year’s tailwinds for semiconductor exports will continue into early 2025.

Aside from ▸Pharmaceuticals (100.0), ▸ Non-metallic materials and products (100.0), ▸ Automobiles and other transportation equipment (100.0), which reported baseline figures (100), there is negative outlook for the remaining 5 industries5). Notably, business trends were negatively impacted by the excess supply from China6)7) in ▸Metals and processed metal products, which includes steel (below the baseline of 100 for the 9th consecutive month8)) and ▸Petroleum refining and petrochemicals (below the baseline for the 6th consecutive month9)).

5) ▸Metals and processed metal products (68.0) ▸Textiles, clothing, leather & footwear (69.2) ▸Petroleum refining and petrochemicals (85.7) ▸Wood, furniture and paper (87.5) ▸Food, beverage and tobacco (93.3)

6) Volume of excess steel supply from China (World Steel Association, tons): 83.8 million (2023) → 110 million (2024)

7) Export Volume of Petroleum Refining and Petrochemicals (Ministry of Trade, Industry and Energy, $ million): 51,999 (2023) → 50,292 (2024), △3.3% reduction

8) BSI Trend of Metals and Processed Metal Products: 100.0 (May 2024)→ 91.2 (Jun)→ 75.0 (Jul)→ 82.1 (Aug)→ 93.3 (Sep)→ 90.0 (Oct)→ 85.2 (Nov)→ 83.3 (Dec)→ 82.8 (Jan 2025)→ 68.0 (Feb)

9) BSI Trend of Petroleum Refining and Petrochemicals: 103.3 (Aug 2024)→ 90.9 (Sep)→ 81.3 (Oct)→ 80.0 (Nov)→ 83.3 (Dec)→ 85.2 (Jan 2025)→ 85.7 (Feb)

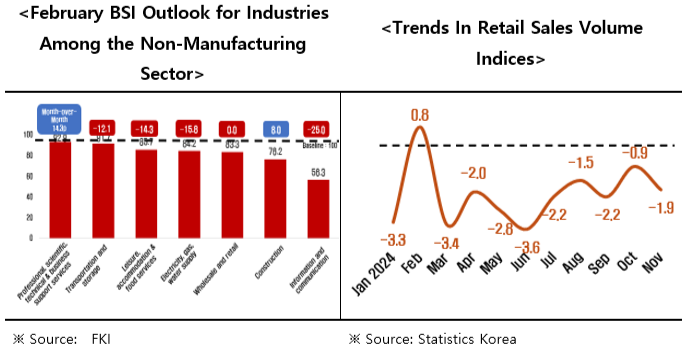

Among the 7 industries among the non-manufacturing sector, ▸Information and communication (56.3), ▸Construction (105.3) and all other industries10) reported negative outlooks. For the first time in 4 years and 7 months (July 2020), all industries among the non-manufacturing sector reported slowdowns. The FKI attributed these negative forecasts to factors such as slowdowns in domestic consumption11)12).

10) ▸Wholesale and retail (83.3) ▸Electricity, gas, water supply (84.2) ▸Leisure, accommodation & food services (85.7) ▸Transportation and storage (91.7) ▸Professional, scientific, technical & business support services (92.9)

11) Retail Sales Volume Index (Statistics Korea, YoY, %): △0.3 (2022)→ △1.5 (2023)→ △2.1 (1Q 2024)→ △2.9 (2Q 2024)→ △1.9 (3Q 2024)→ △0.9 (Oct 2024)→ △1.9 (Nov 2024)

12) Employee Reduction Per Industry In 2024 (Statistics Korea, vs. 2023, No. of employees): Wholesale and retail (△61,000) > Business facility management and leasing (△52,000) > Construction (△49,000) > Real estate (△15,000)

In all survey fields among the February BSI13)14), all items indicate negative business sentiment. Notably, the lowest figures since the COVID-19 pandemic period have been recorded in Domestic demand (86.2), since August 2020 (82.7), 4 years and 6 months ago. Investment (87.9) was also the lowest since the pandemic, since September 2020 (84.6), 4 years and 5 months ago.

13) ▸Domestic demand 86.2 ▸Investment 87.9 ▸Profitability 90.7 ▸Employment 91.5 ▸Financial condition 92.7 ▸Exports 97.5 ▸Inventory 102.5

14) Inventory surpassing the baseline (100) indicates negative outlook

Meanwhile, Exports (97.5) rose by 7.3 points from the previous month (90.2), nearly hitting the baseline. The FKI’s outlook is that the tailwinds in Exports will be sustained in early 2025 but will be limited only to certain industries15) and the difficulty in restoring Domestic demand will lead to a continued polarization between Exports and Domestic demand for an extended period of time.

15) Export Volume Between Jan. 1 and Jan. 10 (Korea Customs Service, YoY adjusted for operating days, %): [Semiconductors] 23.8%, [Automobiles] 4.7%, [Marine vessels] 15.7% VS. [Petroleum refining and petrochemicals] -47.0%, [Wireless communication devices] -23.3%

Sang-ho Lee, head of FKI’s Economic and Industrial Research Department remarked, “Business sentiment has deteriorated significantly due to high exchange rates, rising oil prices, and the rise in internal and external business environment uncertainties.” He maintained, “The prolonged negative business sentiment may result in undue contractions to the real economy, such as in investment and employment. Therefore, it is necessary to swiftly pass the uncontested proposed laws16) aimed at promoting people’s livelihoods and supporting businesses, which would help spur consumption and investment. In addition, there is a need to refrain from legislative activities that may inhibit business sentiment, such as making amendments to the Commercial Act.

16) Ex) Expanding tax credits for credit card use in traditional markets, investment tax credit support for semiconductors, extending the duration for the temporary tax credit support, support for structural reform of the construction industry, extending the duration for waiving customs duties for aircraft parts, etc.